Now that you have signed up to an online broker and you've got funds into your account to trade, you are ready to buy your first parcel of shares.

Suppose you want to buy blue chip share, BHP Billiton (BHP)

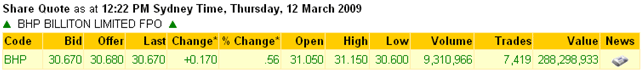

Bid, Offer, Last prices

Here is what each of these prices mean:

Bid - The bid price is the highest quoted price that a buyer is willing to purchase the share at any specific moment

Offer - The offer price is the lowest quoted price that a seller is prepared to sell at any specific moment

Last - The last price is the price at which the share was sold at last

So you want to buy some BHP shares, how much will you pay for it? Well it depends, if you think the offer price of $30.68 is a good price you’re willing to pay then you might want to buy it at $30.68. However if you feel it's priced too high then you can set your buy price at $30.50.

This is the same as for selling, if you feel $30.68 is too low a bid you can set your offer price at $30.80.

When you set a specific price to buy/sell shares, it is called an "At Limit" order.

If you really want to buy these BHP shares but you're not sure at what price to set, then you can put in a "At Market" order. You might be thinking what is the advantage of putting an "At Market" order, why not juts put down the offer price of $30.68? The simple reason is that you don’t want to miss the opportunity. The offer of $30.68 is only available at that specific moment, by the time you are ready to buy, it may have risen to $30.80 or above. Basically an "At Market" order will guarantee that you will get those BHP shares as long as there is a seller.

Placing your order

At Market

At Market orders are as easy as they come. When you place an At Market order you are telling your broker to buy/sell shares at the current asking price. That's it.

One thing to note is that you may or may not get your shares at the price you saw it last (last price), this is because the last asking price may have changed between the time you looked at it and the time you finalise the order.

For example: You look at the BHP shares above and you are happy with the 'Last' price of $30.67, so you put in an 'At Market' order. What can happen is that between the time you were sending the order and the time the order was executed the BHP shares may have risen to $30.80. However most the time the price will be very close if not the exact same price.

At Limit

To avoid the situation above, paying too much or selling at too low, you need to make an At Limit order. Lets say you feel the BHP shares are too expensive at $30.67, what you can do is put a At Limit order of $30.50. This means when the share price hits or goes below $30.50 your broker will buy that share.

At Limit orders usually comes with time limits, when you make the order you can either have it as "good for day" or "good-to-cancel/default expiry", for Comsec the default expiry is 20 days. "Good for day is" is only valid for the current trading day and will expire at the end of the day if the order is not executed.

Placing orders by online, phone or in person

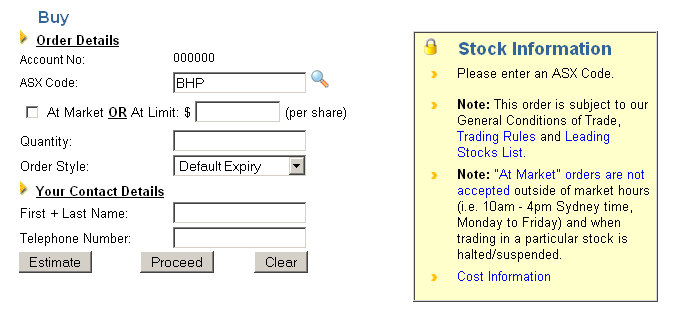

Even though you can place orders via phone or in person, buying shares via the internet with online brokers is by far the most popular and easiest way. Below is an example of Comsec's basic stock order.

To fulfil the order, just tick At Market or put in a price for At Limit, put down the quantity of shares you want and if you want the order for the default expiry (20 days) or good for day (just for current day), enter you contact details and click submit.

Once the order is executed you need to ensure you have the funds in your account within 3 business days. This is because by law, all transaction needs to be 'settled' 3 days from when they are executed, also known as the T + 3.

And that's it. You have completed your first trade, congratulations you are now a share owner!