One of the most important lessons you need to learn before you start investing, whether that be shares or property, is to manage risk. Of all the common asset classes, shares are the most risky. It is true that the share market can offer great returns over short periods, but just as likely it can nose dive with the same speed. So it is vital that you have strategies in place to reduce the level of risk. One of the most effective strategies to reduce risk is through diversification.

Diversification simply means not to put all your eggs into the one basket. The aim is to ensure that, at any time, part or if not all of your portfolio is performing well. For example had you bought $50,000 worth of Telstra shares in Jan 2000 for $8.20, you would have made a substantial loss as Telstra shares are now worth $3.20 (20/5/09). Had you diversified your portfolio and made smaller investments in various companies then the loss wouldn't have been as great to your overall portfolio. Essentially what you are doing is spreading the risk and insulating yourself from any possible downturns. Diversification also allows for a more consistent performance under a range of economic conditions. Unfortunately of the 6.5 million people who owns share directly in Australia, 25% of them own just the one stock and over 50% have 3 or fewer shares in their portfolio.

Different Sectors

OK, so we know that the second share you buy will diversify your portfolio just that little bit more. However while having shares in Commonwealth Bank (CBA), National (NAB), ANZ bank (ANZ), Westpac (WBC), Bank Of Queensland (BOQ) is better than having just the one alone, you can still be in trouble because all those companies fall under the same sector, - the financial sector. If something were to happen to the financial sector (the current financial crisis for example 21/5/09) then your portfolio will be decimated. What you can do to further diversify your portfolio is by entering into other sectors such as energy, materials, industrials, consumer discretionary, consumer staples, health care & utilities. Don't just dump everything into one HOT sector! One great example of this is the tech boom of 2000, had your portfolio contained mostly IT stocks you would have been down substantially.

Asset Allocation Diversification

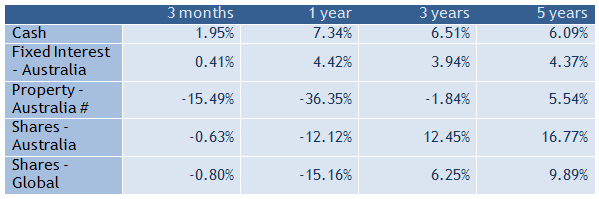

To diversify your investment portfolio even further you can enter into different asset classes. Asset classes are a group of "building blocks" of an investment portfolio. Financial professionals agree that there are 4 different assets classes. They are cash, fixed interest, property and shares. Let’s have a look at the returns of asset classes for the last 5 year periods to the end of June 2008.

#listed property indices source: Index data to 30 June

If you look at the table above we see that over 5 years Australian and Global Shares have produced healthy returns, 16.77% and 9.89% respectively. However if we look at the returns at 1 year we see that the same shares are down -12.12 and -15.16%. If your portfolio contained only shares as the sole asset class, then it would have been a very bad year. The same can be said with property, if you only had property as the sole asset you would have been down -36.6%. If, however your portfolio included cash and fixed interest then your loss would have been minimised some what.

Diversifying with Managed Funds, Index Funds & Exchange Traded Funds (ETFs)

So how far do we have to go in terms of diversifying? Do we need 20 stocks? 100? Invest globally? It would be ideal but for the average investor this is not feasible. One of the most effective way to diversify your portfolio even with as little as $5,000 is to invest in managed funds, index funds or exchange traded funds or combinations of all. These funds can capture up to 95% of capital markets.

Remember, investing is not all about hot stocks that can produce spectacular returns; investors should spend just as much time managing risk as the return side. Before you start buying any shares it is important you decide what your level of risk is.