- Articles

- Shares

- What does ex-dividend mean? How to ensure you receive your dividends

OK, now that we understand the concept of a share dividend, let’s go through what it means when a share goes ex-dividend. It is important to understand this as it can affect your decision as to whether you should keep or sell a particular stock. If you are unsure what dividends are please read the dividends guide. Here's a brief recap;

In most cases, a company will pay out two dividends per year (interim dividend and a full year dividend), when they report the results. Basically this is a nice little cheque you will receive for owning the company's shares. This money is the profit the company has made throughout the period – the half year or the full year - usually the bigger the profit the higher the dividend, although not all companies pay a dividend. Many investors use the strategy of holding on to shares that pays a high dividend yield ("dividend investing" or "dividend trading"), and with the current financial crisis it’s not a bad strategy.

The dividend process starts off with the board of directors getting together to discuss the dividend amount and a set of dates. The dates are vital if you wish to receive a dividend from the shares you have purchased. The 2 dates of importance are the ex-dividend date and the "record date". Basically, to receive any dividends from your shares, you've need to have purchased them BEFORE the ex-dividend date. Any shares/securities bought on/after the ex-dividend date will NOT be entitled to receive a dividend. The ex-dividend date is set because companies need to finalise their finances and determine which shareholders are entitled to dividends.

When you purchase shares after the announcement of dividend has been declared up until the ex-dividend date, this is called cum-dividend. Cum dividend or "with dividend" means the shares you own are entitled to dividends but yet to be paid. When the shares are purchased after the ex-dividend date, then the shares are said to be ex dividend "without dividends".

Another date that is of importance is the Record Date, this is the date where you need to keep hold of your shares till, i.e. if you sell your shares before this date, you will NOT receive a dividend even if you purchased the stock before the ex-dividend date.

The 4 Important Dates for a Dividend

- The Declaration Date: The date in which board of directors of a company announces to shareholders that the company will be paying a dividend

- The Ex-Dividend Date: The most important date. When you buy shares on or after this date, it is without dividends, i.e. when you purchase shares when it goes ex-dividend, you will not be entitled to any dividends. When shares are purchased before this date, you will receive the dividend.

- The Record Date: This is the date in which a company looks at their records to see who is on the list to receive a dividend. To receive any dividends you MUST be on that list, i.e. do not sell your shares before this date!

- The Payment Date: This is the date when dividends are paid to shareholders who was on the record date list.

For example

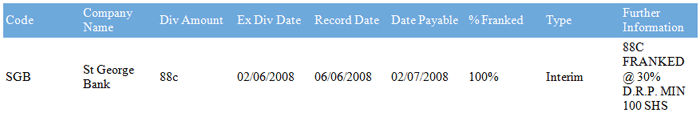

Here is a real life example of St George Bank (SGB)

To receive any dividends, you must:

- Purchase the SGB shares BEFORE 02/06/2008

- Pay for them and keep them UNTIL at least the 06/06/08 (4 days after the ex-dividend date)

If you follow this correctly then you will receive your dividends on the 'Date Payable' date (02/07/08)

Ok, so now you know all about dividends, the ex-dividend dates, you might be thinking, what if I buy the shares before the ex-dividend date, keep it till the Record Date and then sell the shares. Won't I make small fortune without too much risk? It'll be like having your cake and eating it too, right? Nice try, when a company announces the ex-dividend date the share price usually fall on this date, with the fall typically equivalent to the amount of dividends paid.

This is something to note for those who have margin loans as the fall on the share price can be dramatic.