There are many benefits to investing in shares and we will investigate how this common form of investment can be an effective way to make money. We will define and explore some of the benefits of investing in shares such as diversification, tax benefits, capital growth and compare it to the traditional high interest savings account (like an ING Direct account or a term deposit).

Owning Quality Companies

Ultimately, owning shares allows you to own a portion of a company (a share). The management team and board of directors effectively work for you, and are there to maximise your wealth. Therefore, they should be acting in a way that benefits you.

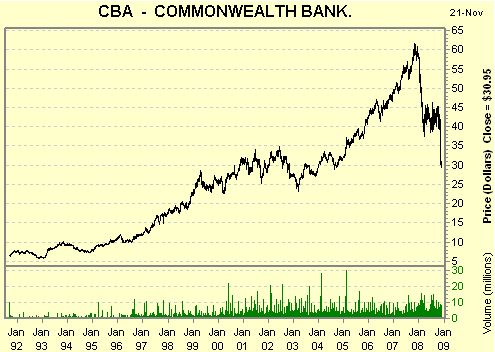

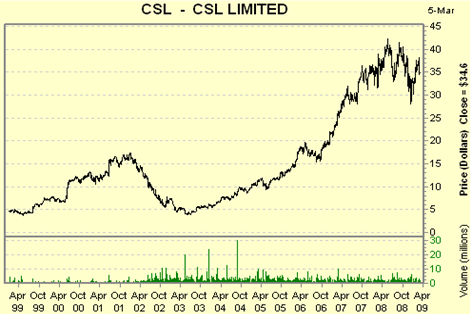

Look at the following graphs of quality blue chip companies Woolworths (WOW), CSL Limited (CSL) and Commonwealth Bank (CBA):

Looking at the above graphs we can see that shares have the potential to generate great returns. However, it also shows (mid 2007 onwards) that shares can also be risky. Investors deciding to invest in shares should have a long term view, this means 5-7 year time frame.

Greater Returns: Best Investment over time

Shares have been popular with investors historically because shares have had better returns compared to other investments, such as bonds and cash in the bank.

Below are the overall gains of different investment types over the last 10 years to December 2007.

| Overall Returns |

13.3% |

11.6% |

12.7% |

5.6% |

4.6% |

It is important to understand that the past performance does not necessary mean a company will perform in the same way in the future.

Perhaps you are thinking: "why not just keep money in the bank" as there isn’t much risk associated with that. While keeping your money in a savings account (e.g. ANZ savings account) seems like a safer option, the returns are almost non existent if you factor in inflation.

For example: You may be happy with the bank offering you 5% interest per annum on your money, however if you factor in inflation, which can be 4%, then your investment is only growing at a mere 1% per annum. If you add in the tax benefits of owning shares it soon becomes obvious that putting money in the bank isn’t such a great idea anymore.

For an investment to be growing, you need capital growth, which means share price increases beyond inflation (the general increase in the cost of things you buy day to day).

Ease of Diversification

Diversification is simply not putting all your eggs in one basket. If you make smaller investment in various different companies, the likelihood that one of your investments fails means that it won’t have a great affect on your total investment. If you have all your eggs spread between a number of baskets (investments), you are more insulated from any possible downturns. Because you can buy small parcels of shares ($500 is the minimum per parcel), you can get greater diversification though investing in shares. Compare this to say property where a large sum of money is placed in just one investment.

Liquidity

Another benefit of investing in shares is that it is a liquid asset.

With shares, you can log onto various websites and buy and sell easily. The market for shares is large (for the large blue chip companies), meaning you can find buyers and sellers to fulfil your request. E.g. If you want liquidate your portfolio (sell everything), it’s relatively easy to find buyers. Compare this to selling property, where you may have only 1 or 2 interested buyers.

Availability of Information

Information about a particular companies share, especially blue chip shares, are just about everywhere, news on TV, newspaper and most financial websites. You get to know up to the minute value of your share portfolio. Also, part of listing on the Australian Stock Exchange, they must report information to their shareholders through ASX announcements, including financials (full year and half year), news that may affect the share price, such as acquisitions and divestments and respond to queries relating to large movements in their share price. This disclosure ensures that all share holders are kept up to date on their investment.

Tax Benefits

Many of the costs associated with share trading are tax deductible, as you have to pay tax on your gains. Transaction fees, interest paid on margin loans and other costs associated with your investments can be deducted as an expense from your taxable income from the shares you’ve traded. Tax benefits can also come from franking credits (imputation credits) from shares. As companies have already pay tax on their profits investors receive franking credits on the dividends they receive.